The Single Strategy To Use For Eb5 Investment Immigration

Table of ContentsThe 45-Second Trick For Eb5 Investment ImmigrationRumored Buzz on Eb5 Investment ImmigrationThe Definitive Guide to Eb5 Investment ImmigrationThe Ultimate Guide To Eb5 Investment ImmigrationMore About Eb5 Investment Immigration

While we make every effort to supply precise and updated content, it needs to not be thought about lawful recommendations. Migration laws and policies undergo change, and specific situations can differ widely. For individualized guidance and legal guidance concerning your certain migration situation, we strongly advise speaking with a certified migration attorney who can give you with customized assistance and guarantee conformity with present legislations and regulations.

Citizenship, via investment. Currently, since March 15, 2022, the amount of financial investment is $800,000 (in Targeted Work Locations and Backwoods) and $1,050,000 elsewhere (non-TEA zones). Congress has actually accepted these amounts for the next five years beginning March 15, 2022.

To receive the EB-5 Visa, Financiers should develop 10 full-time united state jobs within 2 years from the day of their full financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement guarantees that investments contribute straight to the U.S. work market. This uses whether the tasks are created directly by the company or indirectly under sponsorship of a marked EB-5 Regional Center like EB5 United

Some Known Questions About Eb5 Investment Immigration.

These tasks are determined via versions that utilize inputs such as development prices (e.g., building and construction and devices expenses) or yearly earnings generated by ongoing operations. In contrast, under the standalone, or direct, EB-5 Program, only direct, full-time W-2 worker placements within the business might be counted. A key danger of depending only on straight workers is that personnel decreases because of market problems could lead to insufficient full time positions, potentially causing USCIS denial of the financier's application if the work creation requirement is not met.

The financial version then projects the variety of straight tasks the new company is likely to create based upon its expected incomes. Indirect jobs computed via financial models describes work produced in sectors that provide the products or services to business directly included in the job. These work are developed as a result of the raised need for items, materials, or services that sustain business's operations.

The 6-Second Trick For Eb5 Investment Immigration

An employment-based 5th choice group (EB-5) financial investment visa offers a method of coming to be a Visit Your URL long-term U.S. citizen for foreign nationals wishing to spend capital in the United States. In order to obtain this permit, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Facility within a "Targeted Work Area") and produce or maintain a minimum of 10 permanent work for United States workers (omitting the capitalist and their immediate family).

Today, 95% of all EB-5 funding is elevated and spent by Regional Centers. In several regions, EB-5 investments have filled the funding space, giving a new, vital important link resource of capital for local financial development tasks that revitalize areas, create and support jobs, facilities, and solutions.

Some Known Questions About Eb5 Investment Immigration.

Even more than 25 nations, consisting of Australia and the United Kingdom, use comparable programs to attract international investments. The American program is more stringent than lots of others, requiring significant danger for capitalists in terms of both their economic investment and immigration condition.

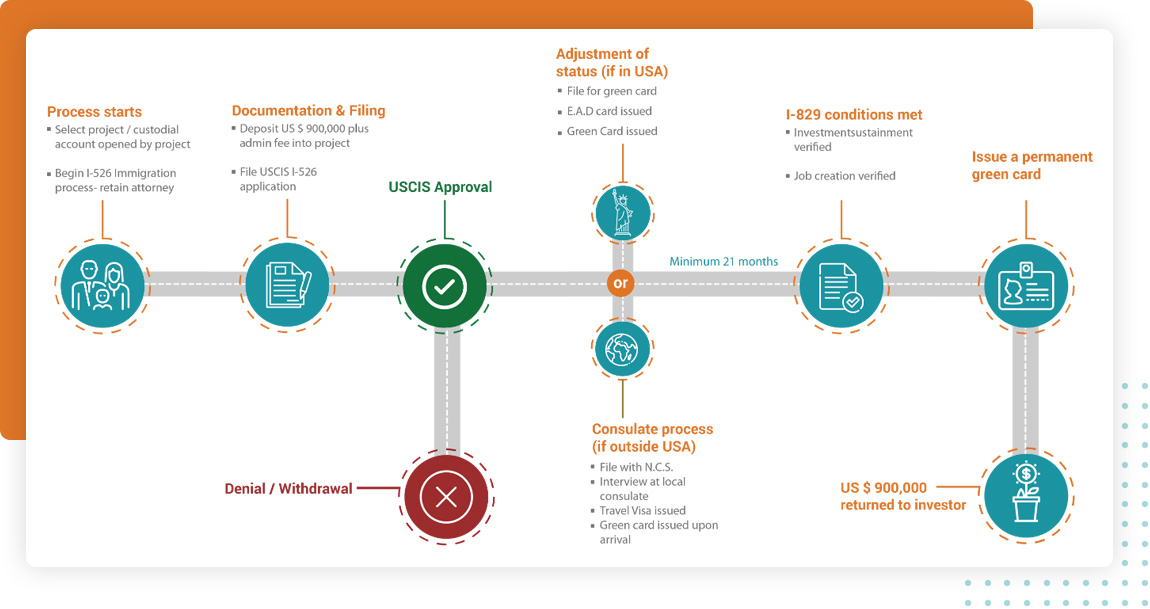

Family members and people that seek to move to the United States on a long-term basis can use for the EB-5 Immigrant Capitalist Program. The United States Citizenship and Migration Solutions (U.S.C.I.S.) established out numerous requirements to get long-term residency with the EB-5 their website visa program.: The very first action is to locate a qualifying investment chance.

Once the possibility has been recognized, the capitalist has to make the financial investment and submit an I-526 request to the united state Citizenship and Migration Provider (USCIS). This application needs to include evidence of the financial investment, such as financial institution statements, acquisition agreements, and service plans. The USCIS will certainly evaluate the I-526 request and either authorize it or demand added evidence.

Eb5 Investment Immigration Can Be Fun For Anyone

The investor needs to get conditional residency by sending an I-485 request. This petition should be sent within 6 months of the I-526 approval and need to consist of proof that the investment was made and that it has actually produced a minimum of 10 permanent jobs for U.S. employees. The USCIS will certainly examine the I-485 petition and either approve it or demand extra proof.